Irrevocable Life Insurance Trusts are really not complicated, despite how they may appear. In this blog, we’ll discuss what you need to know about them, in simple terms.

Read MoreThe US equity market posted positive returns for the quarter and outperformed non-US developed markets but underperformed emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

During the quarter, interest rates decreased within the US Treasury market.

Generally, changes to individual taxes are positive but with limitations for higher income taxpayers in the highest brackets. Proactive tax planning will be crucial in many cases.

The estate tax exemption amount was increased tom $15 million per person, indexed to inflation starting in 2026. Wealth transfer and gifting strategies may need to be reviewed.

OBBBA expands provisions from the 2017 Tax Cuts and Jobs Act (TCJA) to favor small business owners. Business owners should consider ways to take advantage of this.

On July 4th, 2025, President Trump signed into law the One Big Beautiful Bill Act (OBBBA), which was subsequently approved by Congress. This bill has many implications. In this blog we will discuss what it means for individuals of high net worth and people in the higher tax brackets.

Read MoreDespite their growing importance, digital assets are often ignored when it comes to estate planning. For those that inherit or try to administer estates today, they could be facing a crisis trying to unlock the immense possible value of what gets left behind. This blog will teach readers what they need to learn about digital asset estate planning.

Read MoreLong-term U.S. Treasury yields have risen, even as inflation data softens. Concerns appear to be rising regarding our country’s fiscal trajectory and debt.

Proposed legislation, including the “Big Beautiful Bill,” points to further spending and borrowing, reinforcing investor concerns about U.S. creditworthiness.

We are also seeing renewed interest in international markets as investors seek diversified opportunities amid shifting global capital flows.

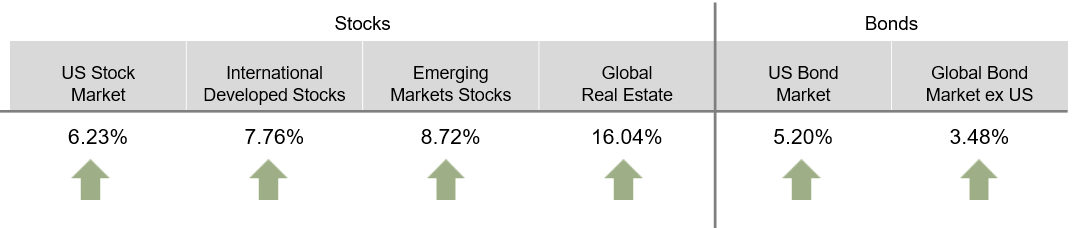

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets.

US real estate investment trusts underperformed non-US REITs during the quarter.

During the quarter, short- to intermediate-term interest rates decreased, and long-term interest rates increased within the US Treasury market.

If you're prepared, diversified, and focused on the long game, you'll not only survive a recession—you might even thrive.

Read MoreWhat happens when you earn too much to make a Roth contribution? Are high-income earners bound to miss? While that may have been an intention when creating these income limits, there are still a few ways to work around these restrictions, namely the Backdoor Roth IRA strategy.

Read MoreI know from speaking with our clients, some have collected or inherited large coin collections of various types of currencies over the years and have found difficulty knowing how to catalog it all, as well as how to value their coin collection.

Read MoreThe US equity market posted negative returns for the quarter and underperformed both non-US developed and emerging markets.

Developed markets outside of the US posted positive returns for the quarter and outperformed both US and emerging markets.

US real estate investment trusts underperformed non-US REITs during the quarter.

Some are worried that Social Security may not be there when they retire. Even without increasing taxes, the Social Security system is projected to be able to pay 73% of promised benefits all the way out to the year 2098.

The primary source of Social Security funding—payroll taxes—is continuous. As long as people are working, the system collects revenue. Currently, payroll taxes cover about 77-80% of benefit payments even without trust fund reserves.

Unlike private financial schemes, Social Security is backed by the full faith and credit of the U.S. government. Congress has adjusted Social Security multiple times in its history, including the 1983 reforms, which raised the retirement age and increased payroll taxes to stabilize funding. Future adjustments will likely follow a similar path.

California residents affected by the devasting wildfires, especially in Los Angles are experiencing emotional heartbreak. Our hearts go out to you. Many have lost not only their homes but also a lifetime of memories. But what is causing this crisis, and what can you do to protect yourself from not being about to renew insurance after the LA wildfires?

Read MoreUS stock markets had an excellent year in 2024 and outperformed international and emerging markets.

The price-to-earnings (P/E) ratio discount of international stocks vs. US stocks is greater today than the 20-year average.

It makes sense to rebalance your portfolio when your stock allocation gets either too far above or below the target allocation.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

Developed markets outside of the US posted negative returns for the quarter and underperformed the US market, but outperformed emerging markets.

Within the US Treasury market, interest rates generally increased during the quarter.

The 2025 IRS Super Catch Up Rule is about to make it easier for some workers to save more for retirement—and the timing couldn’t be better.

Read MoreVenmo, Zelle, PayPal… all the new ways society is getting used to sending, receiving, and requesting cash without ever needing a physical wallet. However, as we start to track more finances on our smartphones, the IRS is using the data to better enforce the tax code. Here is what consumers need to know about changes in the IRS tracking of cash transactions.

Read MoreThe IRS has your Bitcoin on their radar - get prepared before the grace period ends on December 31st! There are some big changes on the brink when it comes to how you report Bitcoin on your taxes. This blog presents a summary of what you need to know about changes in Bitcoin (and other digital asset) income tax reporting for 2025.

Read More