Having Trouble with Insurance Renewal Since the LA Fires?

California residents affected by the devasting wildfires, especially in Los Angles are experiencing emotional heartbreak. Our hearts go out to you. Many have lost not only their homes but also a lifetime of memories. But what is causing this crisis, and what can you do to protect yourself from not being able to renew insurance after the LA wildfires?

Before we get started, we are financial advisors in La Jolla, California, serving the local area and beyond. We have written the following blogs about finance that California residents may find useful:

Step up basis in community property states like California

California For All College Corps

California Small Business Relief Programs

And now onto the blog!

Why Are Insurance Companies Pulling Back after the LA wildfires?

For the past decade, insurance companies have gradually excluded coverage for natural disasters such as wildfires, earthquakes, floods, and landslides from standard homeowners' policies. The United Nations reports that natural disasters have increased threefold in the past 50 years, and insurance companies, relying on actuarial data, are struggling to predict and cover the escalating risk (2021.)

As climate change continues to pose higher risks, many insurers have realized that they can’t afford to insure areas that are at a high risk for these types of disasters. This shift has left many residents vulnerable, particularly those in fire-prone regions like California. Insurance coverage after the LA wildfires is likely to look very different for California residents.

What Does This Mean for You?

California, especially areas like LA and Pacific Palisades, has always been a high-risk zone for wildfires. As fires continue to ravage communities, many residents have faced the disheartening reality of having their fire insurance canceled. In some tragic cases, people who lost their homes in the fires still have to continue paying their mortgages.

This is why it’s more important than ever to review your homeowner's insurance policy and ensure it covers all potential risks, particularly natural disasters.

Review Your Insurance Policy: Be Prepared

It’s essential to fully understand what your homeowners' policy covers and what your premiums are going to pay for. Many people assume that their policy automatically includes coverage for fires, floods, earthquakes, and other natural disasters, but that’s not always the case. Some of these perils may require additional, separate coverage.

Let’s take flooding as an example.

Imagine a major flood damages your home.

If you have a standard homeowners' policy, it will likely cover damages from flooding if the water enters your home from the roof.

However, if the flood water starts coming in from the sides of your home or affects your basement, you might not be fully covered.

Basic policies typically cover only the first floor, and if you have a basement, it’s usually limited to the walls and floors—anything you’ve stored in the basement may not be covered at all (toilets, bedroom furniture).

Moreover, 20% of insurance claims come from outside high-risk flood areas (NAIC).

Basic HO Policy Natural Disaster Coverage

Note: Image generated by Gemini 2.0 Flash, March 2025 [Artificial intelligence system]. https://gemini.google.com/

What if your fire insurance was cancelled and you are having a hard time getting renewal?

The California Fair Access to Insurance Requirements (FAIR) was established in 1968 to help California residents in high-risk areas obtain fire and earthquake coverage in urban and rural areas who are unable to obtain insurance through a regular insurance company (aka private insurance). This plan covered 3% of California residents in 2020 but has gone up drastically since insurance companies started not renewing coverage.

However, the FAIR Plan isn’t a perfect solution. It does not estimate the full market value of your home or the cost to rebuild, and it may not cover all your needs in the event of a disaster. For many, this means needing additional coverage to fill the gaps.

While more insurers are pushed towards the FAIR Plan, going forward it will be able to cover fewer claims and push up the cost for households across the state. This may cause insurers to leave, intensifying the insurance crisis.

Protecting Yourself with DIC Insurance

If your fire insurance was canceled or if you’re struggling to get a policy renewal, you may want to consider adding a Difference In Conditions (DIC) policy. DIC policies are designed to provide coverage for high-risk perils, such as floods, earthquakes, and other catastrophic events that may not be fully covered by the FAIR Plan.

While the cost of a California FAIR Plan policy plus a DIC policy averages around $3,200 per year, it’s worth considering for those living in high-risk, fire-prone areas. Combining these policies fills in coverage gaps and offers more comprehensive protection.

We have provided a link to view what insurers sell DIC policies. Additionally, if you have both a FAIR Plan policy and a DIC policy, you may qualify for discounts if you bundle your auto and umbrella policies with the same DIC carrier.

Is there hope for CA homeowners?

Much of the news has been filled with a lot of discouragement and many people are wondering if things are going to get better when it comes to insurance coverage after the LA wildfires. Are homeowners with private insurance going to have to pay the supplemental fee for long?

Back in a January, 2024 blog, we discussed this insurance crisis and whether or not there is any hope that it will improve, “California Homeowner’s Insurance Crisis- What should you do? Since the recent disasters, California Congressman have introduced legislation, The Disaster Resiliency and Coverage Act of 2025, which provides homeowners in disaster-prone regions with broad incentives to harden their properties against wildfires and other natural hazards to help address the ongoing insurance crisis in California and other states. By incentivizing homeowners to mitigate disaster risks on their property, the legislation will help bring insurers back into the market and lower rates.

The legislation includes the establishment of a grant program, administered through State governments, through which certain individual households in designated disaster-prone regions are eligible for up to $10,000 for specified hazard mitigation work on their homes.

The legislation also provides a 30% tax credit for these mitigation activities conducted by individuals, farms, and businesses. The credit complements the grant program by providing meaningful assistance to larger property owners for whom mitigation activity costs would far exceed $10,000.

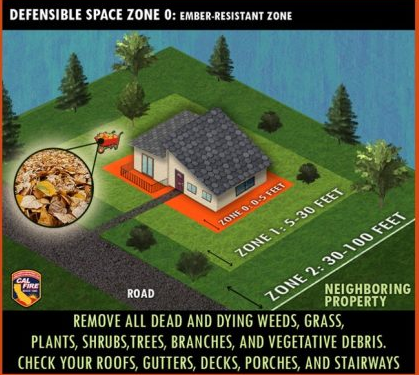

For San Diego residents, this goes hand in hand with the new Defensible Space for Fire Protection ordinance that have now set forth various requirements property owners must comply with to increase the resilience of their properties.

The ordinance directs to establish a 0-5 foot “ember-resistant zone” that requires fuel and vegetation management around structures. We have provided an illustration from Cal Fire to show what that means for your home. Going forward, future Home Risk assessments will include the ember resistance zone to prevent against wildfires.

Why Insurance Matters

The purpose of insurance is to give you peace of mind, knowing that you're covered if something unexpected happens. If you live in a high-risk area and rely on the FAIR Plan, adding a DIC policy can help ensure you’re fully protected.

We understand that navigating insurance policies after the LA wildfires can be overwhelming, especially with recent changes. We strongly recommend working with an insurance broker, financial advisor, and real estate attorney to fully understand your options and the risks associated with the coverage you’re considering.

If you need help or have any questions, don’t hesitate to reach out to us at Financial Alternatives. We’re here to support you through these challenging times and help you secure the protection you need.

Marcelle joined Financial Alternatives in 2024 as a Financial Planning Analyst. She assists senior advisors with the financial planning process for clients. A recent graduate with a BS in Finance from San Diego State University, Marcelle will soon begin her education requirements to sit for the CERTIFIED FINANCIAL PLANNER® exam.

Sources:

California Fair Plan Property Insurance. https://www.cfpnet.com/how-to-apply/

California Department of Insurance. California FAIR Plan. https://www.insurance.ca.gov/01-consumers/200-wrr/California-FAIR-Plan.cfm

California Department of Insurance. List of Insurers that Sell Difference in Conditions (DIC) Policies. https://www.insurance.ca.gov/01-consumers/105-type/5-residential/carriersDICpolicies.cfm

Image generated by Gemini 2.0 Flash using the prompt, "Create me a cartoon image of a house with a broken roof and water coming through the roof, put a check mark above the house." March 2025 [Artificial intelligence system]. https://gemini.google.com/app?is_sa=1&is_sa=1&android-min-version=301356232&ios-min-version=322.0&campaign_id=skws&utm_source=sem&utm_source=google&utm_medium=paid-media&utm_medium=cpc&utm_campaign=skws&utm_campaign=2024enUS_gemfeb&pt=9008&mt=8&ct=p-growth-sem-skws&gad_source=1&gclid=CjwKCAjwvr--BhB5EiwAd5YbXsomNC-vN8ZsWkUNUhqV1f4qp_fbXaGQiHvV-J3vcx-S5qkX-3IecBoCO_AQAvD_BwE&gclsrc=aw.ds

Image generated by Gemini 2.0 Flash using the prompt, " Create me a cartoon style image of water coming out from the sides of a house and a large red X above the house." March 2025 [Artificial intelligence system]. https://gemini.google.com/app?is_sa=1&is_sa=1&android-min-version=301356232&ios-min-version=322.0&campaign_id=skws&utm_source=sem&utm_source=google&utm_medium=paid-media&utm_medium=cpc&utm_campaign=skws&utm_campaign=2024enUS_gemfeb&pt=9008&mt=8&ct=p-growth-sem-skws&gad_source=1&gclid=CjwKCAjwvr--BhB5EiwAd5YbXsomNC-vN8ZsWkUNUhqV1f4qp_fbXaGQiHvV-J3vcx-S5qkX-3IecBoCO_AQAvD_BwE&gclsrc=aw.ds

NAIC. Flood Insurancehttps://content.naic.org/consumer/flood-insurance.htm

University City Community Association. 2025, March 4th. University City News. March 4 2025 – Fire Protection Zone 0 Workshop re CA’s new Defensible Space regulations. https://www.universitycitynews.org/2025/03/02/march-4-2025-fire-protection-zone-0-workshop-re-cas-new-defensible-space-regulations/

United Nations. (2022, April 26th). More than one disaster a day looming without action on risk reduction, UN warns. https://news.un.org/en/story/2022/04/1117022

United Nations. (2021, March 18th). United Nations. Natural disasters occurring three times more often than 50 years ago: new FAO report. https://news.un.org/en/story/2021/03/1087702

United States Congressman Mike Thompson. 2025, February 10th. Thompson, Lamalfa Introduce Bill To Help Alleviate California Insurance Crisis, https://mikethompson.house.gov/newsroom/press-releases/thompson-lamalfa-introduce-bill-help-alleviate-california-insurance-crisis#:~:text=The%20Disaster%20Resiliency%20and%20Coverage,in%20California%20and%20other%20states