Even if you don’t have student loans, please use this information to help your friends, children, or grandchildren.

Read MoreYour financial life is complicated, and it pays to automate and simplify it.

While automation can streamline our finances, it’s essential to monitor your accounts regularly to detect any irregularities and ensure everything is running smoothly.

Should you also be worried? It’s helpful to look at what has happened to the stock market during past shutdowns.

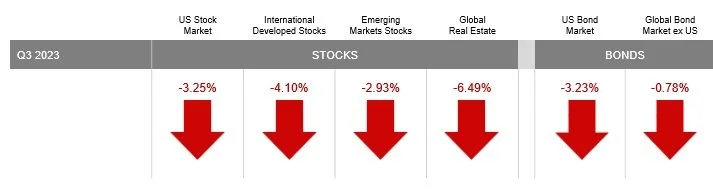

Read MoreThe US equity market posted negative returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets

Interest rates increased across all bond maturities in the US Treasury market for the quarter

Emerging markets posted negative returns for the quarter and outperformed both US and non-US developed markets.

Are you thinking about filing for Social Security benefits and/or Medicare? Here are some helpful points to help you do a self-check to ensure your application process goes smoothly, so that you can avoid hiccups, and maximize your benefits.

Read MoreAfter completing post-childhood support goals of funding an education, wedding, or travel expense, being able to help a child purchase their first home is frequently a goal of our clients. For many families, it brings a sense of satisfaction in setting up their children up to achieve their own life goals. However, when done without the proper planning, it has the potential to create family and financial tension.

Read MoreIn the past century, there have been 15 recessions in the US. In 11 of those instances, stock returns were positive two years after the recession began.

Stock markets typically drop well before a recession is officially announced and then rebound before the recession is officially over.

Commit to holding onto your portfolio’s stock allocation for the long term and rebalancing it if markets drop due to a recession or any other event that may trigger a bear market

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

The Bloomberg Commodity Total Return Index returned -2.56% for the second quarter of 2023.

The 1% strategy has many applications to the process of growing wealthy, from saving more money to building a business or even getting a new insurance quote. These small victories, done consistently, do add up over time.

Read MoreUS Bank is in the process of converting all Union Bank checking and savings accounts, mortgages, investment accounts, and credit cards to their platform.

Read MoreEvery family should create a Family Emergency User Manual. This is your family’s financial and operational blueprint in case an unexpected crisis happens.

Communicate or leave a Trail on How to Find your User Manual.

Consider gifting to family members or charities during your life so you’re able to enjoy seeing others benefit from your generosity.

The US equity market posted positive returns for the quarter and underperformed non-US developed markets, but outperformed emerging markets.

REIT indices underperformed equity market indices.

Across equities, Value and Small caps underperformed Growth and large caps.

I am excited to announce that Andrew is now a Shareholder Partner with Financial Alternatives.

Read MoreDuring tax season, a common question we hear from clients is, “How will custodial account income from my children’s accounts be treated for taxes?” The answer is that it depends on how much income was realized over the course of the year, if they have earned income from work, and whether Kiddie Tax comes into play.

Read MoreThe US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets

Emerging markets posted positive returns for the quarter and outperformed the US market, but underperformed non-US developed markets.

The Bloomberg Commodity Total Return Index returned +2.22% for the fourth quarter of 2022.

2022 was the seventh worst calendar year loss for the S&P 500 Index since the 1920s, down -18.1%.

The 13% drop in the Aggregate Bond Index for the year was over 10% greater than any other annual drop in this index’s history!

Since 1928, the S&P 500 Index has experienced two or more consecutive negative years just eight times.

Develop the habit of reviewing your estate planning documents and beneficiary designations on a regular basis. We recommend doing this at least every two to five years at a minimum and always after any significant life event.

Even a young adult should have the following estate planning documents: Advanced Health Care Directive, Financial Power of Attorney, Beneficiaries for accounts, Last Will and a Digital Will.

The recently signed bill by President Joe Biden was a $1.7 trillion omnibus spending bill which includes Secure 2.0 Act retirement savings legislation. This landmark legislation includes many changes to retirement savings. Here’s a rundown of some key points that we think may have direct impact on your retirement saving strategies.

Read More