Vanguard’s 10-year forecast for U.S. equity returns is 2.3% to 4.3% per year; and for global equities it’s higher at 5.2% to 7.2% per year.

Market corrections are a good time to rebalance your portfolio and add back to stock holdings.

History shows that reaching a new market high doesn’t mean the market will then retreat.

It is wise to have a plan in place for the possibility of reduced future investment returns.

Emerging markets fell 2.5% for the year, underperforming both US and non-US developed equity markets.

The Bloomberg Commodity Index Total Return returned -1.56% for the fourth quarter of 2021.

Interest rate movements in the US Treasury fixed income market were mixed during the fourth quarter.

Taxpayers may receive up to $7,500 as a federal tax credit for electric cars in 2022. In this blog we will discuss what the credit is, how it works, and more.

Read MoreSingle taxpayers with taxable income less than $400,000 and married filing jointly (MFJ) taxpayers with taxable income less than $450,000 should not see much change in the taxes they pay as a result of the changes under the new Biden tax plan.

Some taxpayers with income below $400,000 and $450,000 could see tax reductions due to the return of the state and local tax deduction.

If your income is above this $400,000 and $450,000, expect your taxes to go up.

The US equity market was flat for the quarter and outperformed non-US developed markets and emerging markets

In emerging and developed markets, most currencies depreciated vs. the US dollar

The Bloomberg Commodity Index Total Return returned 6.59% for the third quarter of 2021.

Here is a complete guide to buying solar panels for your home in which we cover many of the commonly asked questions.

Read MoreThe tragic loss of life from collapse of the Champlain Towers South in Surfside Florida should be a wake-up call to condo boards across the country. Being on a Homeowners‘ Association (HOA) board is a serious job that comes with it a high degree of responsibility. Board members need to ensure the safety of residents as well as protect themselves. Here are five things you can do to help protect yourself from personal liability while serving on a HOA Board.

Read MoreStaying diversified and disciplined, avoiding market timing, and maintaining a long-term investment perspective is a better course of action.

Market timing is the attempt to own stocks when they are rising, sell them high before they fall, and buy them back at lower prices before they rise again.

Understanding the history of bear markets and maintaining a long-term focus helps investors remain calm and take appropriate action during corrections.

Equity markets around the globe posted positive returns in the second quarter. Looking at broad market indices, US and non-US developed markets outperformed emerging markets for the quarter

Emerging markets posted positive returns for the quarter, underperforming the US and non-US developed equity markets.

In developed markets, several currencies appreciated vs. the US dollar, but some, notably the Australian dollar, depreciated. In emerging markets, most currencies appreciated vs. the US dollar, but some, notably the Turkish lira, depreciated.

I am proud to announce that Ellen is now a Shareholder Partner with Financial Alternatives. She has been with us for over eleven years, and we are excited that she has achieved this next step with the firm.

Read MoreWhen you draw up your estate planning documents or your will, you will be asked to name an executor to handle your estate and distribute your property when you die. Here are 10 ways to help your executor now.

Read MoreLife Insurance is not complicated. It was made confusing by those that profit from this confusion

Every policy is either term insurance or term insurance attached to a savings/investment

Insurance is for dying, investments are for living; don’t combine the two.

By combining insurance with investments, it is harder to get the cheapest insurance and optimal investment selections.

The US equity market posted positive returns for the quarter and outperformed non-US developed markets and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

The Bloomberg Commodity Index Total Return returned 6.92% for the first quarter of 2021

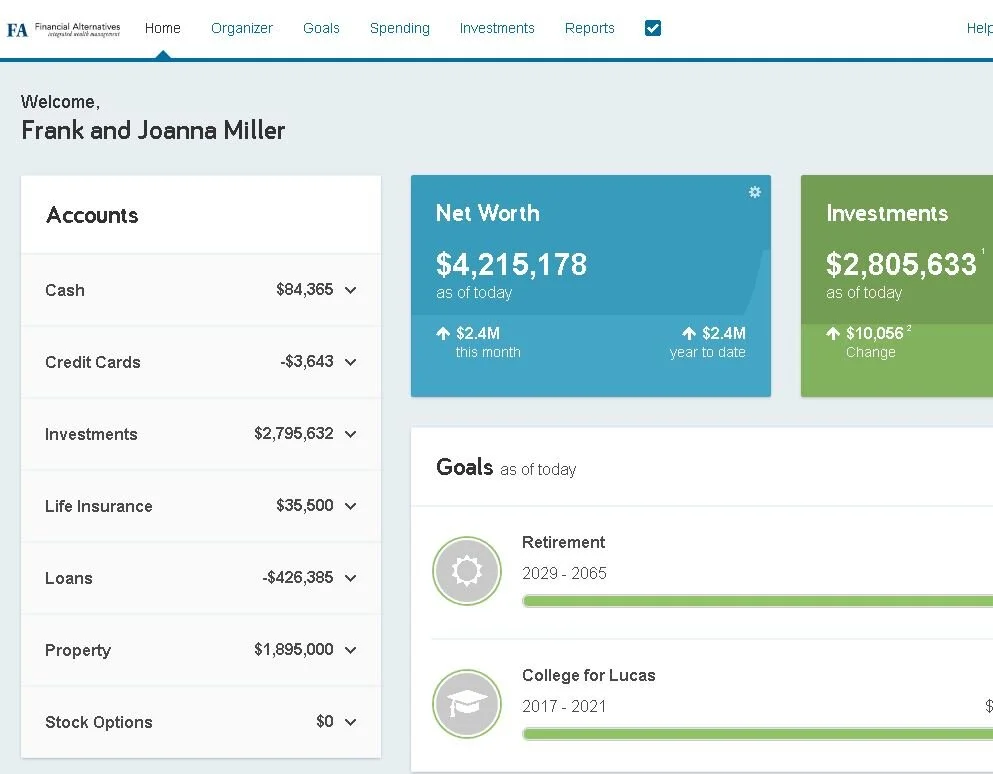

More and more of our clients are using their eMoney Financial Dashboard to get a single, consolidated view of their financial picture. Use these PDF guides to help you get the most out of the site - from just signing up to using advanced features.

Read MoreResources that may help you prepare your 2020 tax return. This includes links to third-party investment company information to calculate tax-exempt income at the state level or foreign taxes paid (which may offset a shareholder’s tax liability).

Read MoreIn this blog we cover the basics of how step up in basis works in a community property state such as California, and what the common mistakes are that people make (that should be avoided).

Read MoreProp 19 has significant impact for residents of the state of California who are looking to pass on property as an inheritance.

Read MoreIn the face of a global pandemic, stock and bond markets performed surprisingly well in 2020.

Last year investors experienced one of the swiftest drops and subsequent full recoveries in stock market history.

We took advantage of the correction and rebalanced portfolios in March when the market was low. We also took advantage of market lows by executing tax-saving tax swap trades.