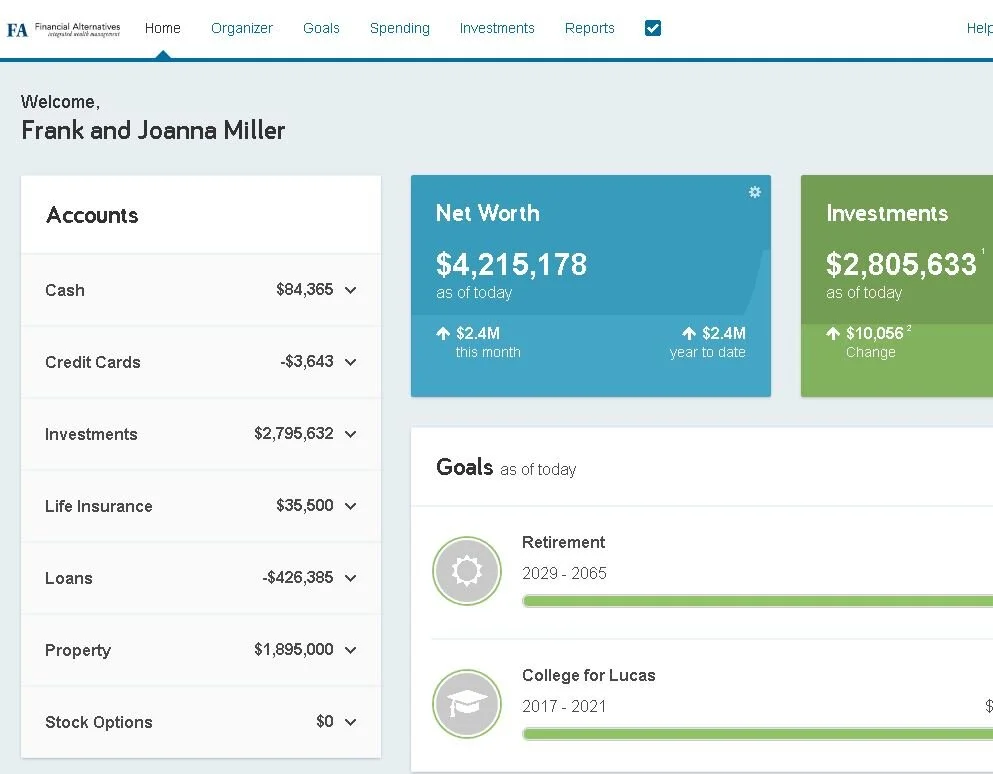

More and more of our clients are using their eMoney Financial Dashboard to get a single, consolidated view of their financial picture. Use these PDF guides to help you get the most out of the site - from just signing up to using advanced features.

Read MoreResources that may help you prepare your 2020 tax return. This includes links to third-party investment company information to calculate tax-exempt income at the state level or foreign taxes paid (which may offset a shareholder’s tax liability).

Read MoreProp 19 has significant impact for residents of the state of California who are looking to pass on property as an inheritance.

Read MoreDo you plan for your child to inherit a home in California? If so, pay attention to recent developments related to Prop 19 and the impact it is likely to have on your property taxes.

Read MoreMost people think of Social Security as a benefit that will come into play in retirement. But have you ever considered the scenarios in which you may need it before that?

Read MoreAs the pandemic has spread, many small businesses have been impacted by the social distancing and stay-at-home orders. If your business has taken a hit, it’s good to know your options under the Stimulus Package. Here is a quick summary of the basics.

Read More

Many of us are now working from home due to the COVID-19 pandemic. Many of the major cities in the United States are on lockdown, and it is expected that many are to follow. Are there any tax tips for working from home during the coronavirus? Read on to find out.

Read MoreThe IRS has announced that the tax filing and payment deadlines for individuals have been extended to July 15, 2020. It is important to note that this extension does not apply to every single thing related to your taxes. Please read this article to learn what is and is not covered in this deadline extension.

Read MoreResources that may help you prepare your 2019 tax return. This includes links to third-party investment company information to calculate tax-exempt income at the state level or foreign taxes paid (which may offset a shareholder’s tax liability).

Read MoreFebruary is a very opportune time when it comes to planning your cash flow. The holidays and new year have passed, but it’s not yet time when people start feeling overwhelmed by tax season. In this “in between” time, take a few moments this month and plan out your cash flows for the year.

Read MoreThe biggest change to retirement savings rules in over a decade is signed into law as part of a government funding legislation put into effect in 2020. The Setting Every Community Up for Retirement Enhancement (SECURE) Act will impact anyone with a 401K or IRA account.

Read MoreThe Social Security Administration website offers a variety of resources. Here’s a new feature that may help you with your retirement planning.

Read MoreTax planning is probably your least favorite activity but you’ll thank us for it. Here are some tax planning ideas for year end 2019 - get this out of the way before the holidays

Read MoreMost companies will have their open enrollment season for employee benefits starting in October. Before you click “submit” – stop! The decision may not be as simple as you think. Pay attention to these three things as you re-up your benefits this fall.

Read MoreThe media is buzzing about the current state of the yield curve as portending an economic recession. We’re not as up in arms as many industry participants and do not feel this is a strong indication that you make a wholesale move out of the stock market. Here’s our view on the current yield curve inversion.

Read MoreIn this blog you will learn what a DC plan is, how it is different from a 401k plan, and the questions to ask yourself if you are wondering if you should invest in your company’s deferred compensation plan.

Read MoreThe Secure Act is on the House’s agenda and it brings with it a series of implications for investors of all types.

Read MoreHere is an excellent guide to employee stock options terminology whether you have just received your award or are already familiar with the terms.

Read More