Taxpayers may receive up to $7,500 as a federal tax credit for electric cars in 2022. In this blog we will discuss what the credit is, how it works, and more.

Read MoreHere is a complete guide to buying solar panels for your home in which we cover many of the commonly asked questions.

Read MoreThe tragic loss of life from collapse of the Champlain Towers South in Surfside Florida should be a wake-up call to condo boards across the country. Being on a Homeowners‘ Association (HOA) board is a serious job that comes with it a high degree of responsibility. Board members need to ensure the safety of residents as well as protect themselves. Here are five things you can do to help protect yourself from personal liability while serving on a HOA Board.

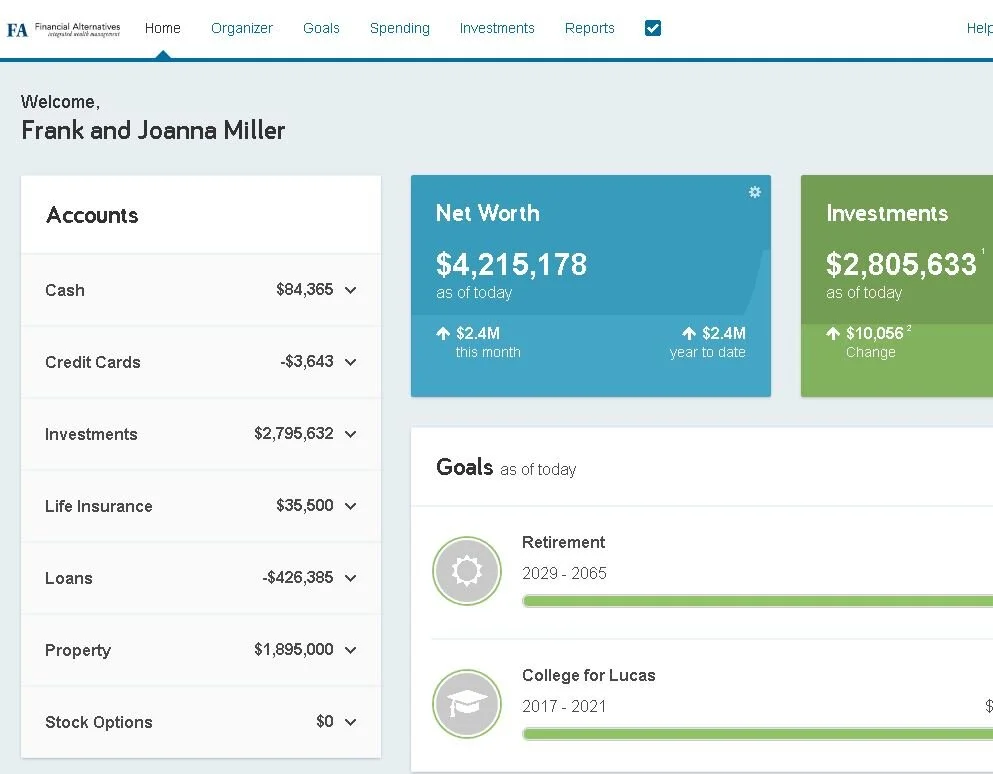

Read MoreMore and more of our clients are using their eMoney Financial Dashboard to get a single, consolidated view of their financial picture. Use these PDF guides to help you get the most out of the site - from just signing up to using advanced features.

Read MoreProp 19 has significant impact for residents of the state of California who are looking to pass on property as an inheritance.

Read MoreDo you plan for your child to inherit a home in California? If so, pay attention to recent developments related to Prop 19 and the impact it is likely to have on your property taxes.

Read MoreIn this article we outline several important facets of historical market performance. This has great relevance to investors who are looking to make successful decisions about how to over or underweight their portfolio positions to maximize performance over the long term.

Read MoreMost people think of Social Security as a benefit that will come into play in retirement. But have you ever considered the scenarios in which you may need it before that?

Read MoreAs the pandemic has spread, many small businesses have been impacted by the social distancing and stay-at-home orders. If your business has taken a hit, it’s good to know your options under the Stimulus Package. Here is a quick summary of the basics.

Read More

Many of us are now working from home due to the COVID-19 pandemic. Many of the major cities in the United States are on lockdown, and it is expected that many are to follow. Are there any tax tips for working from home during the coronavirus? Read on to find out.

Read MoreThe IRS has announced that the tax filing and payment deadlines for individuals have been extended to July 15, 2020. It is important to note that this extension does not apply to every single thing related to your taxes. Please read this article to learn what is and is not covered in this deadline extension.

Read MoreResources that may help you prepare your 2019 tax return. This includes links to third-party investment company information to calculate tax-exempt income at the state level or foreign taxes paid (which may offset a shareholder’s tax liability).

Read MoreNews that the coronavirus is spreading has caused short-term market volatility and it is likely to continue. Although we anticipate that the coronavirus will remain a concern in the coming months, the full and lasting impact on the global economies remains unclear at this point.

Read MoreFebruary is a very opportune time when it comes to planning your cash flow. The holidays and new year have passed, but it’s not yet time when people start feeling overwhelmed by tax season. In this “in between” time, take a few moments this month and plan out your cash flows for the year.

Read MoreThe biggest change to retirement savings rules in over a decade is signed into law as part of a government funding legislation put into effect in 2020. The Setting Every Community Up for Retirement Enhancement (SECURE) Act will impact anyone with a 401K or IRA account.

Read MoreThe Social Security Administration website offers a variety of resources. Here’s a new feature that may help you with your retirement planning.

Read MoreThe best remedy for cybertheft is prevention. Time spent protecting yourself and your family is never spent in vain.

Read MoreMajor custodians such as Fidelity and Charles Schwab have recently dropped individual stock and ETF (Exchange Traded Fund) trading fees to zero. How will this impact investors and the future of investing? Here’s our view.

Read More