What High Earners Should Know About the Tax Cuts and Jobs Act

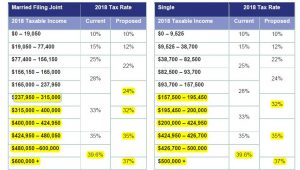

Understanding the implications of the 2017 Tax Cuts and Jobs Act is important for any high earner, or high earning family, who wants to maintain its financial success. As illustrated below, the recent tax reform will modify the tax rate for high income earners. But that’s just where it begins. High earners should also be aware of how the tax code will significantly impact the decisions you are making about your healthcare, business, and gifting decisions.

Table Source: “Highlights of the Final Tax Cuts and Jobs Act, “ by Tim Steffen, 2017 (http://www.investmentnews.com/assets/docs/CI1136191218.PDF)

Payroll Tax- the new tax code will change the way that high income earners are taxed.

There are seven new income tax brackets now (see above). This could mean you might need to adjust your withholdings by filing a new W-4 form.

The new brackets are lower for the majority of tax payers, but with certain common itemized deductions limited or eliminated going forward, you may end up paying more taxes as a result. Review your recent returns and speak to your tax advisor to plan for estimated tax payments.

If you are high income earners and decided not to get married to avoid paying the “marriage penalty” of two high-income individuals paying more in taxes as a married couple you may want to take advantage of the relief offered by this new law. Ask your tax advisor.

Healthcare- financial success doesn’t mean immunity from the pains that high healthcare expenses can bring.

For the 2017 and 2018 tax year, you can deduct out-of-pocket medical expenses that exceed 7.5% of your adjusted gross income, which is down from the current 10 percent. Starting 2019, the deduction floor is reversed back to 10%. It may make sense to accelerate any major medical expenses so that they occur in 2018.

Investment- the new tax code brings several new considerations for successful people who invest for themselves or on behalf of a minor.

Starting 2018, 529 funds can be used toward K-12 education for up to $10,000 a year. Parents, grandparents and others can contribute to 529 accounts up to the annual gift-tax exclusion amount which is $15,000 or $30,000 for a couple per beneficiary. Please note that with anticipated withdrawals to start at an earlier age, the investment allocation for 529 accounts may require adjustment to accommodate a shorter time horizon.

Be aware of potential increase in Kiddie tax. Starting 2018 Kiddie taxes on unearned income will use Trust tax rates, not parents’ rates. In the past a couple earning $120,000/year would have applied the Kiddie tax at 25% bracket, but will now have any unearned income over $12,500 from UTMA account taxed at 37%. This necessitates re-examining your asset allocation and college funding strategy to avoid paying higher taxes.

If you convert your traditional IRA to Roth IRA in 2018, you can no longer change your mind when your accounts decline in value. Going forward, we suggest approaching a Roth IRA conversion with the assumption that it will be a permanent move.

Business- the new tax law will impact successful people across the employment spectrum, from those who work for an established business to those who are self-employed.

Consider changing your working status from “employee” to independent contractor. The new qualified business income 20% deduction for pass-through entities, subject to limitations, may provide some tax planning opportunity. Discuss with your tax advisor to see if this applies to you.

If you’re considering a job switch, include your moving expense in negotiations with potential employers. The moving expense tax deduction is repealed. If you are negotiating for a new job, you might want to include the moving cost in your conversations.

Summing It Up

The implications of the changes in tax code for high earners are too numerous to describe in just one blog post. We recommend revisiting your estate and overall financial plan with your advisor. For example, the fact that the new estate tax exemption doubles to $22.4 million per couple does not eliminate the need to update your estate plan. The potential trap here is the gap between state estate exemption amount and federal estate exemption amount. Don’t get caught facing unexpected state estate tax at the first spouse’s death!

Despite claims of simplicity, the new tax bill is anything but simple. We are here to help with the discussion with your tax and estate advisors, please don’t hesitate to contact us!