Meeting the Retirement Income Challenge: Total Return

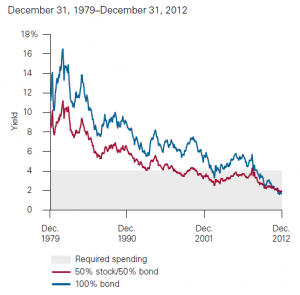

Yields Have Fallen for Traditional Portfolios

It is well documented that portfolio income from bond interest and stock dividends (yield) has fallen for the last 30+ years. As shown below, even the yield from a 100% core bond portfolio has dropped below 4%. Clearly one old rule of thumb – moving to a highly bond focused portfolio as you age – will not supply the income and perhaps even the capital preservation that you need going forward.

Source: Vanguard

Income Only Responses

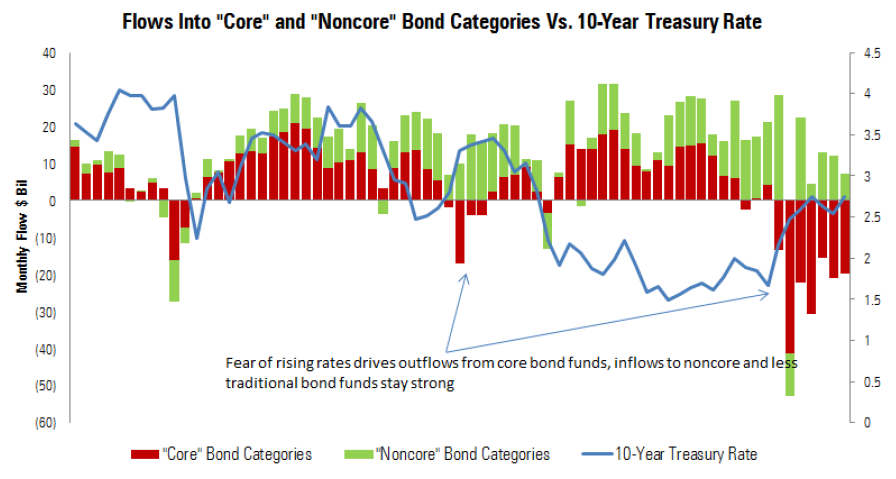

Many investors and advisors have responded to this problem by focusing on replacing the “lost” income (yield) by shifting to different types of investments. These people have been flocking to noncore bonds such as bank-loans, high yield, and other bond styles (as illustrated by the fund flows chart below). In addition, they have added longer-term bonds, high-dividend paying stocks, and other alternatives as ways to boost portfolio income.

Source: Morningstar

Portfolio Impact

Each of these responses has an impact on your investment portfolio:

- Shift to High Yield Bonds >> Increases portfolio Volatility and Credit / Market Risk

- Shift to Longer-term Bonds >> Increases portfolio Exposure to Interest Rate Changes

- Shift to High Dividend Paying Stocks >> Increases Overall Volatility and Exposure to Certain Industries/Sectors

Change to a Total Return Mindset

Instead of emphasizing the income (yield) an investment generates, focus on the big picture of total return from your portfolio. Having an appropriately balanced portfolio and rebalancing it is likely to result in more tax efficiency, lower-risk, and ultimately better outcomes than an income only approach.

So, for a total return investor in early 2014, this may mean lightening up on the stock portion of your portfolio and using the proceeds for living expenses. This may feel odd given the great run stocks have had, but going against your first instincts is often a good idea when it comes to investing.