Buy Low and Sell High – Simple, but not Easy

To “buy low and sell high” is easier said than done as we all know. In fact, it is impossible to consistently time the markets year-in and year-out by being invested only when markets are rising and being out of markets only when they are falling.

So what should you do in your attempt to buy low and sell high (or at least avoid the dreaded “buying high and selling low”)? Fortunately, there is a long-term strategy that will help you and it’s called rebalancing. It is simple but not easy because it requires a disciplined plan along with the courage to implement it through good times and bad.

A Hypothetical Example of Disciplined Rebalancing

Assume you had a $400,000 equity portfolio with 25% in each of the following four investments on January 1, 2013 as listed below:

- $100,000 Vanguard S&P 500 (US Large Company Stocks)

- $100,000 Vanguard Small Cap Value (US Small Company Value Stocks)

- $100,000 Vanguard International Developed Markets (International Large Company Stocks)

- $100,000 Vanguard International Emerging Markets (International Emerging Market Stocks)

As of the market close on 8/7/13 your equity investment would have been worth $440,410 as listed below:

- $120,000 Vanguard S&P 500 (+20%)

- $122,660 Vanguard Small Cap Value (+22.66%)

- $109,840 Vanguard International Developed Markets (+9.84%)

- $87,910 Vanguard International Emerging Markets (-12.09%)

To rebalance the portfolio back to the original 25% equal weighting requires the following trades:

- Sell $9,897.50 Vanguard S&P 500

- Sell $12,557.50 Vanguard Small Cap Value

- Buy $280.50 Vanguard International Developed Markets

- Buy $22,210.50 Vanguard International Emerging Markets

Now each position is worth $110,102.50 and the portfolio has been rebalanced. Did we “buy low and sell high”? In fact we did, we sold most in the investments that went the highest and we bought most in the investment that went the lowest.

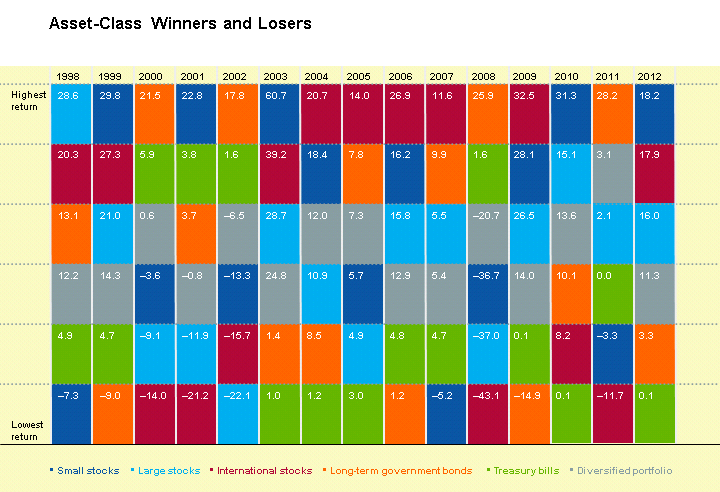

Asset-Class Winners and Losers

As you can see from the graph below, invariably asset classes that have recently experienced strong performance will eventually revert back to more average or below average returns. Conversely, those that have underperformed tend to eventually have stronger performance. This is often caused by people chasing top performing investments and selling under performing investments until at some point a top or bottom is reached and things begin to reverse.

Rebalance with Cash Flows

What if you are in a withdrawal phase of your life and you need to withdraw money from your portfolio to live on? Let’s say you needed to withdraw $40,410 dollars from the above portfolio on 8/7/13 for your required minimum IRA distributions. If you were following a disciplined rebalancing strategy, you would make the following trades:

- Sell $20,000 Vanguard S&P 500

- Sell $22,660 Vanguard Small Cap Value

- Sell $9,840 Vanguard International Developed Markets

- Buy $12,090 Vanguard International Emerging Markets

Now each position is once again worth $100,000. We sold the best performing investments “selling high” and even though we were making a withdrawal; and we still bought the worst performing investment “buying low”. As this illustrates, rebalancing can be accomplished any time new money is added to or withdrawn from your portfolio, or simply at regular intervals such as annually.

Obviously in real life most investors will have fixed income investments in their portfolios so they will often be rebalancing back and forth from stocks to bonds depending on market conditions.

As I wrote earlier, rebalancing and “buying low and selling high” requires a disciplined plan and the courage to follow it through thick and thin. Such a strategy will also help you to better manage your emotions during the inevitable bull and bear markets that await you.