The stock market is at all time highs! Is now a good time to exercise your stock options?

If you do not already know the answer to this question, you are probably not managing your employee stock options effectively or prudently. Managing your options effectively and prudently means having an option exercising and/or hedging plan in place that is well thought out and most importantly integrated with all of your life time financial goals and objectives.

If you are already financially independent, letting valuable in the money options ride in hope of additional profits may be a perfectly prudent thing to do. On the other hand if you have unfunded college costs coming up or you are still building your retirement nest egg, you may not want to take as much risk with these options since a reversal in your company’s stock price would severely affect their value.

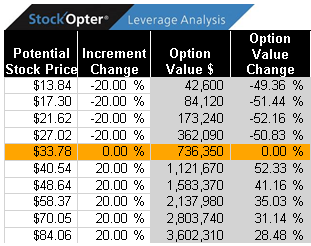

See the graph below which illustrates this. As you can see the stock price is trading at $33.78 and the in the money option value is $736,350. If the stock drops 20% or $6.76 to $27.02, the in the money option value drops over 50% to $362,090. If the stock drops 36% or $12.16 to $21.62, the in the money option value drops over 75% to $173,240!

On the other hand if the stock increases 20% or $6.76 to $40.54, the in the money option value increases over 52% to $1,121,670. An increase in the stock price of 44% or $14.86 to $48.64 would increase the in the money option value by over 100% to $1,583,370! If options have many more years before they expire and the company’s prospects are bright and the stock increases in value, the payoff to holding them can be huge.

This illustrates how option values rise and fall much more than the underlying stock. Because of this, we say that options are leveraged because leveraged investments magnify both gains and losses. Because option gains and losses are magnified, it is even more important to have a solid understanding of your options and a plan for maximizing their value without taking more risk than necessary to achieve your lifetime financial goals.

If you do not have a solid plan and strategy for maximizing your options within the risk parameters that you are willing to take, it will be worth your time to create one or to work with a professional who will help you create a plan.

At Financial Alternatives, Inc. we generate a sophisticated option report to help our clients analyze their stock options and then to come up with a plan that integrates an option exercise and/or hedging strategy into their overall financial planning goals.