Returns for Globally Diversified Portfolios in 2014

Returns for globally diversified portfolios were low in 2014. We periodically refer to GMO (a Boston based investment manager) for their asset allocation insights and their 7-year return forecasts. GMO also manages two globally diversified asset allocation funds. Although GMO has a solid performance track record, in 2014 their Benchmark Free Allocation Funds (GBMFX) had a return of 1.21% and their Global Asset Allocation Fund (GBMBX) had a return of 1.31%.

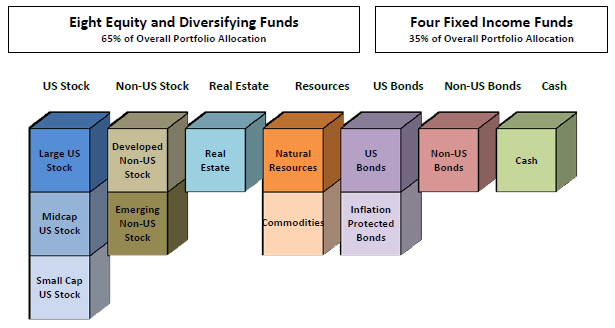

Another globally diversified portfolio that we’ve tracked for years is the 7Twelve Portfolio created by Craig Israelson, a university finance professor who taught at BYU and now teaches at Utah Valley University. As you can see from the graph below his portfolio consists of 7 Broad Asset Categories and twelve different funds with 8.33% of the portfolio invested into each of the twelve funds. The result is a globally diversified balanced portfolio with roughly 65% of the portfolio invested in eight equity funds and 35% of the portfolio invested in four fixed income funds. We use the portfolio as an example because of the readily available return data Israelsen provides on it.

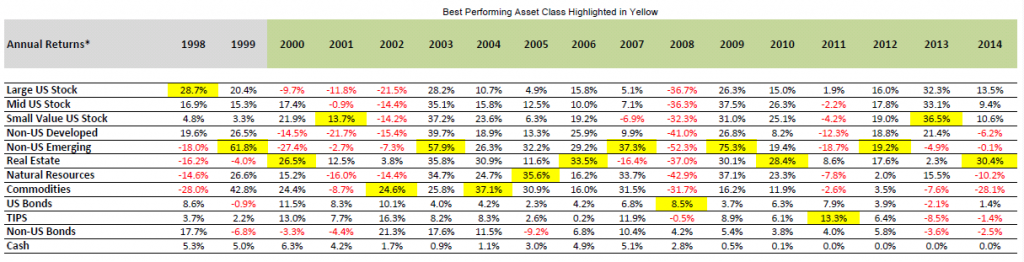

The 2014 return for this portfolio was 1.38% vs over 13% for the S&P 500. These lower returns reflect the portfolios allocation to international, emerging markets, natural resources, commodities and less risky assets such as cash and bonds. In spite of the portfolios poor relative performance compared to the S&P 500 in 2014, it has outperformed the S&P 500 in 10 of the last 15 3-Year rolling periods while taking on significantly less risk.

The five 3-Year periods where the S&P 500 outperformed the 7Twelve portfolio ended in years 2000, 2011, 2012, 2013 and 2014. The year 2000 marked the end of the massive tech stock boom of the late 1990’s, and years 2011 – 2014 followed a strong bull market in US stocks after the 2008 financial crisis.

It is unlikely that this recent stretch of S&P 500 outperformance will continue indefinitely and we encourage investors to continue to hold globally diversified portfolios rather than chase the most recent best performing markets. This is rarely a good strategy to follow because these periods of outperformance and underperformance tend to reverse themselves. We call this the worst to first phenomena in investing.

See the table below which shows calendar year returns for various asset classes from 1998 to 2014. It’s interesting to note how certain asset classes outperform for several years and then the trend reverses itself. An extreme example of this was the time period of 1/1/00 to 3/31/09. During this time the Vanguard Emerging Markets stock fund gained 45.56%, the Vanguard S&P 500 fund lost 36.14% and the Vanguard Total Bond Market fund gained 71.55%. Then from 4/1/09 to 11/31/14 the Vanguard Emerging Market stock fund increased 103.65, the Vanguard S&P 500 fund gained 192.07% and the Vanguard Total Bond Market fund gained 30.09%.

It is impossible to predict which area will be the next top performer. We believe that staying with a diversified portfolio and rebalancing on an ongoing basis helps to avoid the temptation to chase the most recent top performers.