Is it better to invest all at once in a lump sum, or little by little over time (by dollar cost averaging)?

The Prevailing Research

The decision to invest all at once or little by little is one that researchers have addressed many times over the years. The results from a somewhat recent Vanguard research paper pretty much line up with others I have seen: Statistically, an investor is better off investing all at once.

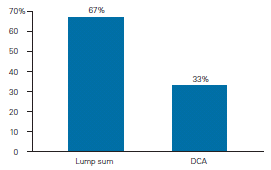

About two-thirds of the time, the immediate Lump Sum Investor (LSI) beat the Dollar Cost Averaging Investor (DCA) who made installment investments over 12 months.

Details Matter

Despite these results, the background and other factors need to be considered when choosing how quickly to invest a cash sum.

The source: Investing cash from an inheritance and investing cash rolled over into an IRA from a retirement plan are very different things. If you DCA the cash rolled over into your IRA – assuming it was previously invested in stocks and bonds – you will be significantly altering your portfolio allocation (by overweighting cash).

The averaging period: If you choose to dollar cost average over 6, 18, or even 36 months, your results may vary significantly. The Vanguard study showed that lengthening the period generally resulted in worse performance for the DCA investor. For example, the LSI beat the 36-month DCA about 90% of the time.

Diversification implied: This study and others like it use index return data - so the results apply to a diverse basket such as a broadly diversified mutual fund, not an individual stock or bond. It’s also interesting to note that the results did not materially change whether investing to a 100% stock, 60% stock/40% bond, or a 100% bond target portfolio.

Risk and Expectations: Essential Considerations

The intuition is pretty straightforward for the Lump Sum Investor: You have relative success over the Dollar Cost Averaging Investor because your money is put to work right away – thereby taking advantage of market growth.

Yet historically, the Dollar Cost Averaging Investor would have seen fewer and smaller losses than the Lump Sum Investor. This could leave the Lump Sum Investor with strong feelings of regret and perhaps lead to self-defeating portfolio adjustments.

Thus, if you face this question of investing all at once or little by little, consider revisiting your willingness and ability to handle losses as well as the future performance of stock and bond markets relative to the historical record.