Simple... And Effective

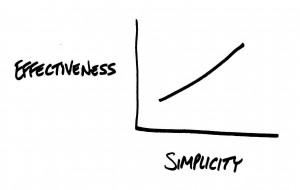

I recently saw the handwritten graph above (relating simplicity with effectiveness), and it reminded me of what we do for our clients on a daily basis.

Look at this graph for a minute. What thoughts come to mind? Is there an area of your life where complexity is limiting your effectiveness?

The principle that increased simplicity can and does lead to increased effectiveness is a simple yet profound idea that has endless applications. Let’s face it: we live in a complicated world that grows more complicated with each passing day.

In our field, financial institutions regularly create complex, costly financial products that are then sold by insurance agents and brokers who are compensated by commissions. These salespeople are clearly not giving objective advice and the results are often inappropriate, ineffective and expensive.

When it comes to financial matters it is almost always best to use simple, straight forward and automatic solutions to reach your financial goals and objectives.

A Few Ways to Keep Your Finances Simple

Goals & Objectives: Review and update your goals and objectives with your partner once a year.

Cash flow: If you are spending more than 15 minutes a month on bill paying and tracking your income and expenses you should streamline and simplify your cash management systems. Consider using: Mint.com (automatically tracks expenses), Paytrust (eliminates paper bills) and our First Step Cash Management system (automates your entire cash flow system) to improve and simplify management of all of your income, expenses and savings. For more information on each of these go to our webpage on Cash Management.

Savings: “Pay Yourself First” by having all your savings and investment goals funded through automatic monthly contributions.

Taxes: Do everything legal you can to reduce your taxes but avoid complicated, costly, tax advantaged, investments and life insurance as well as “too good to be true” tax strategies designed to reduce taxes.

Investments: Avoid all together investments with upfront charges and backend surrender charges that make it complicated and expensive to get out of. Hold your investments in as few accounts as possible.

Stock Options, RSUs and ESPP: Review annually to create an action plan for the year and then carry it out unemotionally.

Life Insurance: Avoid complicated, expensive policies with high surrender charges that make it costly and difficult to get out of.

Auto & Homeowners Insurance: Use high deductibles to avoid filing small claims that will go on your record and only serve to increase your premiums and complicate your life.

Estate Planning: Think twice before executing a complex strategy that may be ineffectual or unnecessary in the end.

Financial Advisors: Only work with advisors who owe you a fiduciary responsibility to do what is in your best interest and are compensated solely on a fee-only basis.